30+ Debt to income ratio for house

Compare that with needing an income near 150000 if you put down only 20. A low debt-to-income ratio demonstrates a good balance between debt and income.

Pin On Best Of One Mama S Daily Drama

As you can see by saving 20 of your income youll hit 25 times your annual income in about 30 years.

. Your debt-to-income ratio also determines whether youre eligible for the type of loan you want and improving your DTI can help you get lower mortgage rates. The 2836 rule is an addendum to the 28 rule. This includes credit card bills car.

Debt-burden ratio DBR is the ratio of an individuals total monthly outgoing payments including installments towards loans and credit cards to the total income. This is important because it can have a big impact on your qualifying debt-to-income ratio DTI. Your debt-to-income DTI ratio compares how much money you earn versus the amount of your debt.

There are two kinds of DTI ratios front-end and back-end which are typically shown as a percentage like 3643. This means your DTI is 30. But it might give you pause.

That means a 30-year-old who starts saving today assuming no prior savings will hit this target by age 60. The budgeting ratio says the order is important. Borrowers with a high DTI ratio may have a high credit utilization ratio which accounts for 30 percent of your credit score.

In general the lower the percentage the better the chance you will be able to get the loan or line of credit you want. 30 is widely considered to be the standard rent-to-income ratio. Monthly debt payments monthly gross income X 100 DTI ratio For example your income is 10000 per month.

The process of buying a house after a divorce or while legally separating from your spouse can be tricky. You must earn an after-tax income of at least 1000 per month to be eligible. For example if you pay 1000 a month in debt bills and you bring home 2000 a month before taxes your DTI ratio is 50.

Age X Pretax Income 10 Net Worth Ratio. To find your DTI ratio divide all of your required monthly debt payments by the amount you earn before taxes. Most responsible lenders follow a 36 percent back-end DTI ratio model unless there are compensating factors.

If youre spending 30 or less of your monthly income on rent then youre most likely in a healthy financial situation. And mortgage lenders will often have in-house caps on DTI ratio that can vary depending on the borrowers. Use this to figure your debt to income ratio.

A house and land package loan or. Youll then subtract all of your recurring fixed monthly debt obligations and minimum payments on credit cards and other lines of credit. By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender.

20 should be immediately saved goals or retirement or put towards paying down debt. 30-Year Fixed 15-Year Fixed FHA Loan VA Loan USDA Loan Jumbo Loan YOURgage. The debt-to-income ratio is an underwriting guideline that looks at the relationship between your gross monthly income and your major monthly debts giving VA lenders an insight into your purchasing power and your ability to repay debt.

For your convenience we list current Redmond mortgage rates to help homebuyers estimate their monthly payments find local lenders. A debt-to-income ratio is the percentage of gross monthly income that goes toward paying debts and is used by lenders to measure your ability to manage monthly payments and repay the money borrowed. 2836 are historical mortgage industry standers which are.

28 of your income will go to your mortgage payment and 36 to all your other household debt. This page provides - United States. Please cite this indicator as.

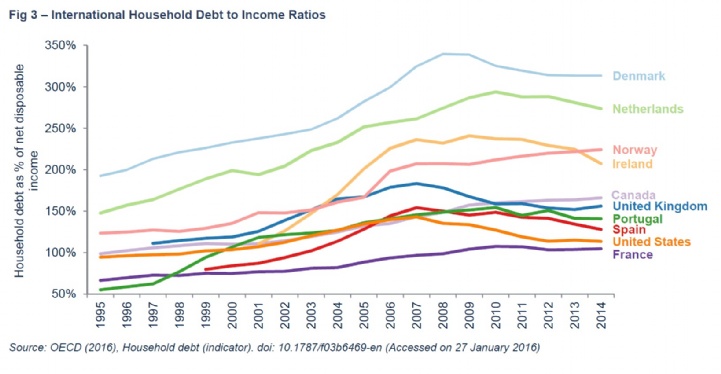

The indicator is measured as a percentage of net household disposable income. Shows what portion of your income is needed to cover all of your monthly debt obligations plus your mortgage payments and housing expenses. How to calculate your home.

Your mortgage property taxes and homeowners insurance is 2000. The loans have repayment terms of three to 72 months. Interest only loans were particularly wound back with approvals limited to 30 per cent of a lenders total loan book.

These home affordability calculator results are based on your debt-to-income ratio DTI. But theres more to this ratio than meets the eye. 10X Your Annual Salary Life Insurance Ratio.

30 should be the. 20-30-50 Budgeting Ratio. Houshold debt is defined as all liabilities of households including non-profit institutions serving households that require payments of interest or principal by households to the creditors at a fixed dates in the future.

Home affordability estimate and monthly payment are based on a 30-year fixed-rate mortgage on a single-family residence with an interest rate of interestRate apr on aprDate for a borrower with excellent credit and user inputs. Lowering your credit utilization ratio will help boost. How To Pay Medical Bills You Cant Afford.

When youre buying a house your debt-to-income ratio influences the size of the loan and the interest rate youll qualify for. A back end debt to income ratio greater than or equal to 40 is generally viewed as an indicator you are a high risk borrower. Take the first step toward the right mortgage.

Save 25X Your Current Income Retirement Savings Ratio. When you spend more than 30 of your income on rent you may find yourself limited when it comes to spending on other expenses and putting away money into. Figure Out How Much You Can Afford.

This includes credit cards car loans utility. A debt-to-income ratio DTI or loan to income ratio LTI is a way for banks to measure your ability to make mortgage repayments comfortably without putting you in financial hardship. To calculate your mortgage-to-income ratio m ultiply your monthly gross income by 43 to determine how much money you can spend each month to keep your DTI ratio at 43.

Government Debt to GDP in the United States averaged 6454 percent of GDP from 1940 until 2021 reaching an all time high of 13720 percent of GDP in 2021 and a record low of 3180 percent of GDP in 1981. Calculate Your Debt to Income Ratio. Divide 900 by 3000 to get 30 then multiply that by 100 to get 30.

With 30 down you could potentially afford a 1037000 home on an income of 140000. Debt Snowball vs Avalanche. This percentage is known as the back-end ratio or your debt-to-income DTI ratio.

The United States Government Debt is estimated to have reached 13720 percent of the countrys Gross Domestic Product in 2021.

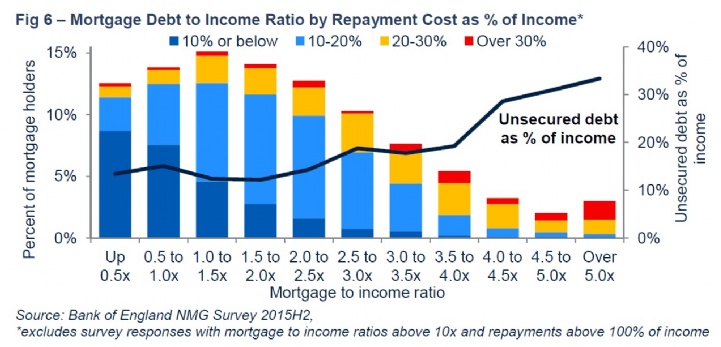

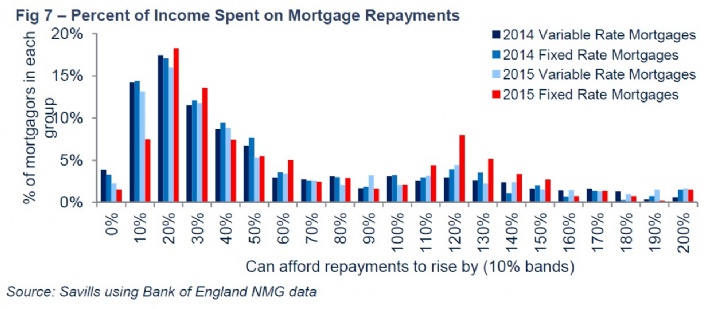

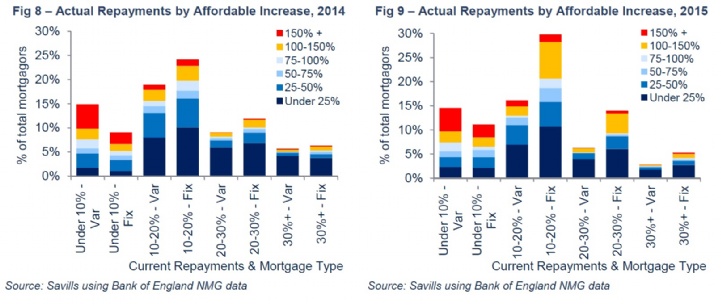

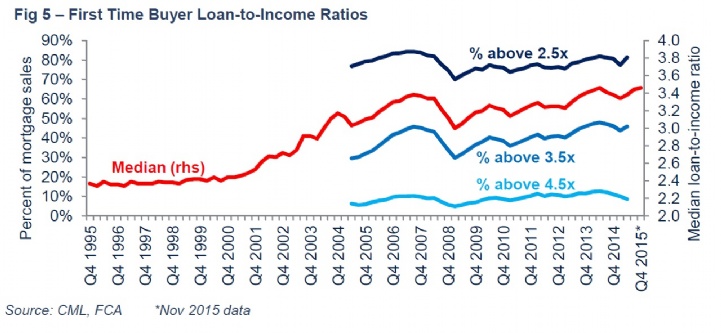

Savills Household Debt

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Savills Household Debt

Top 3 Best Income Statement Template Printable For You You Calendars Income Statement Statement Template Profit And Loss Statement

Savills Household Debt

Citizens Bank Mortgage Rates 5 43 Review Details Origination Data

Savills Household Debt

.jpg)

Savills Household Debt

.jpg)

Savills Household Debt

What Bills Are Calculated In The Debt To Income Ratio Quora

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Pin On Life After College

Savills Household Debt

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

When Banks Evaluate My Debt To Income Ratio Is Income Accounted For The Gross Revenue I Bring In From Work Or Net Income After All My Living Expenses Quora

Business Balance Sheet Template Free Download Balance Sheet Template Statement Template Business Letter Template

What Is The Debt To Income Ratio And Why Is It Important Quora